So it is that chaotic time of the year again where you are buried under files related to the annual report structure for Indian companies. You likely have a mountain of Excel sheets and countless emails from the legal team. Also, a CEO who expects the report to resemble a premium coffee table book. While you might feel the urge to hit the panic button, we are here to ensure you navigate this season smoothly.

In the Indian corporate landscape, an annual report is significantly more than a mere glossy brochure for stakeholders. It is a complex legal minefield governed strictly by the Ministry of Corporate Affairs (MCA) and SEBI regulations. One wrong move with your annual report structure for Indian companies could inadvertently lead to compliance notices. It might also leave your investors thoroughly confused.

This guide acts as your key to unlocking a seamless annual report content writing and designing process. We will break down the exact annual report structure for Indian companies you need to follow. This ensures you stay compliant and look professional.

Why Does the Annual Report Structure Matter for Indian Businesses?

An organized annual report structure for Indian companies is essential. It serves as a primary indicator of corporate governance and operational transparency for both investors and regulators. A messy layout flags you as a risky investment to them. Meanwhile, a clean and logical format builds immediate trust with your stakeholders.

Beyond the obvious compliance needs, the right structure allows you to control the narrative effectively. It guides the reader logically from your brand vision to your hard financial data without any friction.

- Compliance is King: Compliance is effectively the king of corporate reporting, making it absolutely vital that you do not miss any required section. A proper layout ensures you tick every legal box from Section 134 to the complex SEBI regulations.

- Investor Readability: A recent survey indicates that nearly 70% of institutional investors prioritize clear navigation and readability when assessing corporate reports. A standardized annual report structure for Indian companies allows stakeholders to find critical information like EBITDA or ESG goals quickly.

- Narrative Flow: A good structure acts as a guide for the reader. It transitions them smoothly from the corporate overview to the financial statements without causing confusion.

- Risk Mitigation: Listing risks in the Management Discussion and Analysis (MD&A) is vital. A robust framework ensures these disclosures are prominent and satisfy regulatory transparency norms.

What Are the Mandatory Sections of an Annual Report in India?

The mandatory sections generally include the Corporate Overview, Statutory Reports like the Board’s Report and MD&A, and the Audited Financial Statements. These three pillars form the core of every compliant annual report structure for Indian companies regardless of your specific industry or market cap.

Let’s divide this massive document into three key parts: The Story, The Rules, and The Numbers.

What Goes into the Corporate Overview in Annual Reports?

The Corporate Overview is the non-statutory opening section of the report. Here you introduce your brand theme, achievements, and strategic vision to shareholders. While not legally mandated by the Companies Act, it is the most vital part of the annual report structure for Indian companies. This is mainly for branding purposes.

- Theme Introduction: You should start by introducing a central theme that sets the tone for the year and binds the entire document together.

- Vision and Mission: Clearly stating your long-term goals ensures that investors see how your current actions align with your future destination.

- Operational Highlights: Use infographics here to visually display revenue growth or new product launches, making the annual report structure for Indian companies engaging.

- Leadership Messages: The Chairman’s and CEO’s messages are the most read pages, providing a human touch and strategic context to the report.

What Statutory Reports Are Required by Law in Annual Reports?

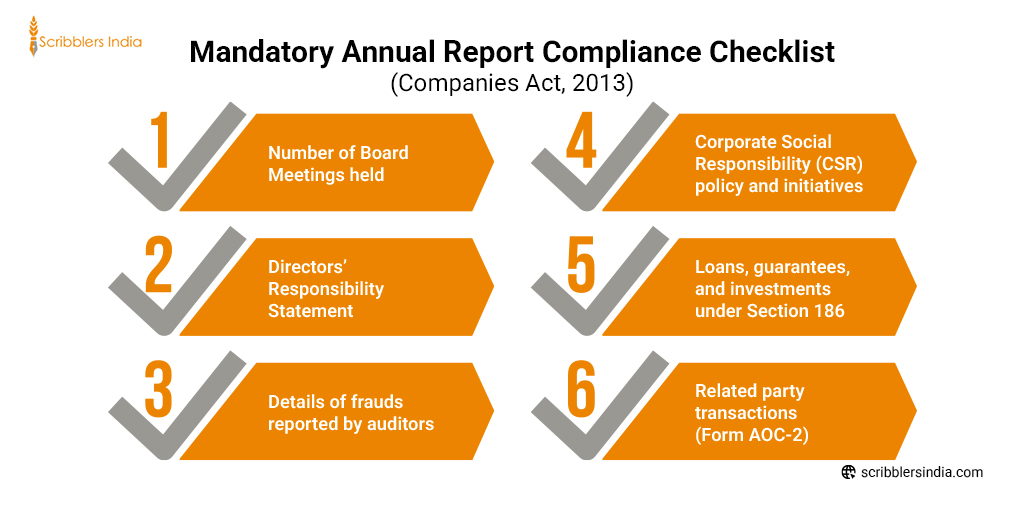

The Statutory Reports section covers legal disclosures mandated by the Companies Act 2013 and SEBI Listing Regulations (LODR) for public companies. This is the non-negotiable core of the annual report structure for Indian companies. It demands absolute precision and attention to detail.

According to recent data from Prime Database, the average length of annual reports has increased by approximately 20% recently. This change is due to enhanced disclosure norms like BRSR.

- Board’s Report: This is mandatory under Section 134. Your document must include this comprehensive section covering the state of affairs, reserves, and dividend recommendations.

- MD&A (Management Discussion & Analysis): This explains the reasons behind the numbers. A standard annual report structure for Indian companies uses this section to analyze industry trends, opportunities, and threats.

- Corporate Governance Report: This is crucial for listed firms. It details board composition and committee meetings, forming a key element of the SEBI Annual Report Requirements.

- Sustainability Reports (BRSR): Top 1000 listed companies must file a Business Responsibility and Sustainability Report. Integrating this into your layout shows your commitment to ESG.

- Secretarial Audit Report: Form MR-3 is essential for larger companies. It confirms compliance with various laws and must be annexed in the final report.

How Should You Present Financial Statements in Annual Report?

The Financial Statements section presents the audited economic performance of the company. It includes the Balance Sheet, Profit and Loss Account, and Cash Flow Statement. This section is the quantitative foundation of the annual report structure for Indian companies. It also must be error-free.

- Standalone vs. Consolidated: You must present both if you have subsidiaries. A correct layout clearly separates the parent company’s data from the group’s performance.

- Auditor’s Report: This is the seal of trust. The Independent Auditor’s Report validates the accuracy of your financials and is a non-negotiable part of the annual report structure for Indian companies.

- Balance Sheet and P&L: These are the primary documents. Ensure they follow the Schedule III format of the Companies Act 2013 to maintain compliance.

- Notes to Accounts: Here is where the details live. Significant accounting policies and contingent liabilities are explained here, meaning no report is complete without them.

Is There a Standard Table of Contents I Can Copy?

Yes, you can follow a standard template that moves logically from corporate identity to statutory compliance and finally to the financial tables. Following a proven annual report structure for Indian companies saves time and ensures you do not miss critical inclusions.

Here is a literal cheat sheet list to help you organize your annual report format in India:

- Start with the Corporate Identity and Theme to establish the context for the annual report structure for Indian companies.

- Provide a 5-year or 10-year Financial Highlights summary as investors often look for this snapshot early in the document.

- Include Leadership Messages from the Chairman, MD, and CFO to add necessary authority to your report.

- Explain your Business Model and Strategy to connect your financials directly to your operations within the annual report structure for Indian companies.

- Include the Statutory Reports such as the Board’s Report, MD&A, and Corporate Governance Report as the regulatory heart of the document.

- Place the Standalone and Consolidated Financial Statements toward the end as this is the traditional closing section.

- Conclude with the Notice of AGM to finalize the annual report structure for Indian companies for your shareholders.

How Do You Make the Non-Statutory Section Engaging?

You make the non-statutory section engaging by using storytelling and high-quality visuals. A clear narrative theme that simplifies complex data for the reader also helps. This is the only flexible area in the annual report structure for Indian companies. Here, your creativity can truly shine.

Investors are humans who appreciate a good story, so use this space wisely to build an emotional connection.

- Humanize the Data: You should use case studies to show how your CSR initiatives impacted real people to add depth to your report.

- Use Infographics: Replace dense text with charts. Visuals make the annual report structure for Indian companies digestible for readers skimming through the document.

- Focus on Brand Photography: Avoid stock images. Real photos of your employees and facilities make the content authentic and relatable.

- Simplify the Language: Avoid jargon where possible. A clear voice makes the report accessible to retail investors and not just analysts.

If you are unable to figure out the ideal approach here, then working with a professional annual report writing services provider can be a good approach. They allow you to focus on other core tasks while handling the intricacies of this process.

What New Trends Are Shaping Annual Report Structures in 2026?

The major trends shaping the annual report structure for Indian companies in 2026 include digital-first formats, integrated reporting, and minimalist design. Companies are rapidly moving away from print-heavy documents toward interactive and sustainable reporting methods to reach a wider audience.

Staying updated helps you stand out in a crowded market and demonstrates that your company is forward-thinking.

- Digital-First: Companies are building micro-sites. This modern approach allows for videos and interactive charts that static PDFs cannot offer.

- Integrated Reporting (<IR>): This framework links financial capital with human and social capital. It is becoming a premium keyword for the annual report structure for Indian companies among top-tier firms.

- Minimalism: Less is more. The annual report design trends in 2026 favor whitespace and bold typography over dense paragraphs in the layout.

- ESG Prominence: Sustainability is no longer a footnote. It now takes center stage in the annual report structure for Indian companies often appearing before the financial review.

Why You Need Annual Report Writing Services in India

Creating a compliant annual report is a massive undertaking. It often distracts your core team from their actual jobs. You need a partner who understands both the Sections of the Companies Act 2013 and the art of storytelling.

At Scribblers India, we specialize in developing annual reports that satisfy regulators and impress investors.

- Strategic Storytelling: We do not just dump data. We craft a narrative that resonates with investors and builds brand equity within your annual report structure for Indian companies.

- Regulatory Expertise: Our team stays updated on the latest SEBI, MCA, and GRI standards. We ensure you never miss a compliance check in your report.

- End-to-End Management: From the first draft of the Chairman’s message to the final proofread of the financials, we handle the chaos of the annual report structure for Indian companies.

- Visual Harmony: We work closely with designers. This ensures your content and visuals speak the same language throughout the document.

- Timely Delivery: We understand that statutory deadlines are not suggestions. We guarantee on-time delivery for every project involving annual report content writing for Indian companies.

Get your annual report structure sorted. Book a 1:1 consultation with our team. Learn more about our annual report writing and designing services during the session.

Final Thoughts: Don’t Let the Format Scare You

Structure equals clarity. A well-defined annual report structure for Indian companies turns a statutory obligation into a powerful branding tool. It builds trust with stakeholders and keeps the regulators happy.

You have the blueprint now. Go build a report that does not just sit on a shelf. Make it tell your story. And if you get stuck? You know where to find your favorite annual report writing agency in India.

Frequently Asked Questions (FAQs)

Is the annual report structure the same for private and public companies?

No, the annual report structure for Indian companies differs based on listing status. Listed companies face a heavier burden with SEBI regulations and BRSR. Meanwhile, private limited companies follow a leaner version under the Companies Act 2013.

What is the most important section for investors?

While they check the Financials for health, investors read the MD&A (Management Discussion and Analysis). This section of the annual report structure for Indian companies helps them understand the business’s future potential and strategic direction.

Can we change the order of sections in the annual report?

Yes, the Non-Statutory front section is flexible. However, the Statutory Reports and Financials usually follow a standard order within the annual report structure for Indian companies. This standardization is for the convenience of auditors and regulators.

What is the difference between the Board’s Report and the MD&A?

The Board’s Report is a formal compliance declaration to shareholders. The MD&A is a strategic analysis of why the business performed as it did, making it essential to the annual report structure for Indian companies.

Do all Indian companies need to file a Business Responsibility and Sustainability Report (BRSR)?

Currently, it is mandatory for the top 1,000 listed companies by market capitalization. Others can do it voluntarily within their annual report structure for Indian companies, and should do so to impress global investors.