Are you wondering what is the need for Wikipedia page creation services for your FinTech brand? Wikipedia stands as a pivotal resource in the digital age, averaging over 11 billion page views per month, which translates to approximately 132 billion page views every year. This immense traffic highlights the platform’s global prominence in disseminating information.

For fintech companies, establishing a presence on Wikipedia can significantly enhance visibility and credibility. A well-crafted Wikipedia page informs the public about your company’s mission and services, and serves as a testament to its legitimacy and influence in the financial technology sector. Availing trusted Wikipedia page creation services can ensure your page meets editorial standards while preserving neutrality and factual accuracy.

The fintech industry itself is experiencing remarkable growth. In 2023, the global fintech market was valued at approximately $79.38 billion. Projections indicate that this figure will exceed $141.18 billion by 2028, reflecting the sector’s rapid expansion and its increasing impact on the global financial landscape.

What is the Strategic Value of Wikipedia for Fintech Companies?

Trust remains the lifeblood of success in financial services. Your potential customers and partners who research your fintech company will find a well-managed Wikipedia page that signals:

- Established presence: Your company meets Wikipedia’s strict notability criteria

- Third-party validation: Independent editors have verified information about your company

- Transparency: A neutral forum documents your company’s history, services, and accomplishments

Wikipedia consistently ranks among the world’s top 10 most popular websites, attracting nearly 500 million unique visitors each month. This massive audience sees Wikipedia as an authoritative source. This gives fintech brands an unparalleled opportunity to establish their legitimacy.

How Wikipedia Supports Fintech Growth in 2025?

A Wikipedia page for FinTech companies brings substantial business growth benefits that boost your bottom line in 2025. This makes Wikipedia an increasingly valuable asset for strategic growth.

Investor due diligence and Wikipedia presence

Investors need detailed due diligence during investment rounds. They analyze your company’s financial, legal, and market situations before investing capital. A detailed Wikipedia page serves as a central source of information, aiding this evaluation process. Investors value Wikipedia because:

- It shows third-party confirmed information about your fintech’s history and achievements

- The neutral point of view rule gives a balanced presentation of facts

- Community verification happens continuously to increase reliability

- It documents funding rounds, partnerships, and growth metrics for financial context

Wikipedia as a trust signal for potential partners

Trust signals help stakeholders feel confident about working with your business. A fintech wiki page becomes a strong trust signal by:

- Showing your company’s notability and market presence

- Giving third-party proof of your company’s claims

- Making your business model and operations transparent

- Proving stability in an ever-changing industry

Supporting international expansion through localized Wiki pages

Localized Wikipedia pages facilitate market entry for fintech companies seeking global growth. This makes international presence a crucial requirement.

Companies can educate new markets about their services through localized Wikipedia entries. These pages build credibility with regional stakeholders and adapt to local cultural contexts. Companies should maintain Wikipedia pages in the languages of their target markets to support their international growth plans.

What are Wikipedia’s SEO Benefits for Fintech Firms?

A Wikipedia page for FinTech companies gives you amazing SEO advantages that are way beyond the reach and influence of simple visibility. Your fintech brand can reap significant benefits through domain authority, referral traffic, and backlink opportunities, thereby enhancing its online presence.

Domain authority and search ranking advantages

Domain authority shows how relevant a website is for specific subject areas or industries. This directly affects search engine rankings. Wikipedia has incredible domain authority and scores at the top of the 1-100 scale developed by Moz. Your fintech company gets a share of this authority when mentioned on the platform.

Google and other search engines evaluate backlinks to determine a page’s significance. Your site’s credibility receives a boost from search engines when you create a company Wikipedia page. Although Wikipedia’s “nofollow” links do not directly pass link equity, they enhance your site’s authority with search engines.

Wikipedia as a referral source for website traffic

Wikipedia pages usually rank high in search results. This makes them excellent sources of referral traffic for fintech firms. A Wikipedia page citation can help you:

- Get steady qualified traffic from readers who want more information

- Stand out to people searching for information

- Receive passive traffic through Wikipedia’s strong organic search performance

- Build trust before visitors land on your website

Leveraging Wikipedia citations for Backlink Strategy

Wikipedia backlinks have “nofollow” status that limits direct SEO benefits. However, these citations create opportunities for valuable secondary links. Your Wikipedia citation becomes a “link magnet”.

Content creators and journalists frequently use Wikipedia as a primary research source, particularly for fintech-related content. They tend to reference your company in their content after seeing it cited on Wikipedia. This creates more high-quality backlinks.

This second-tier backlink approach is practical because Wikipedia’s stringent editorial standards inform other publishers that your content warrants citations.

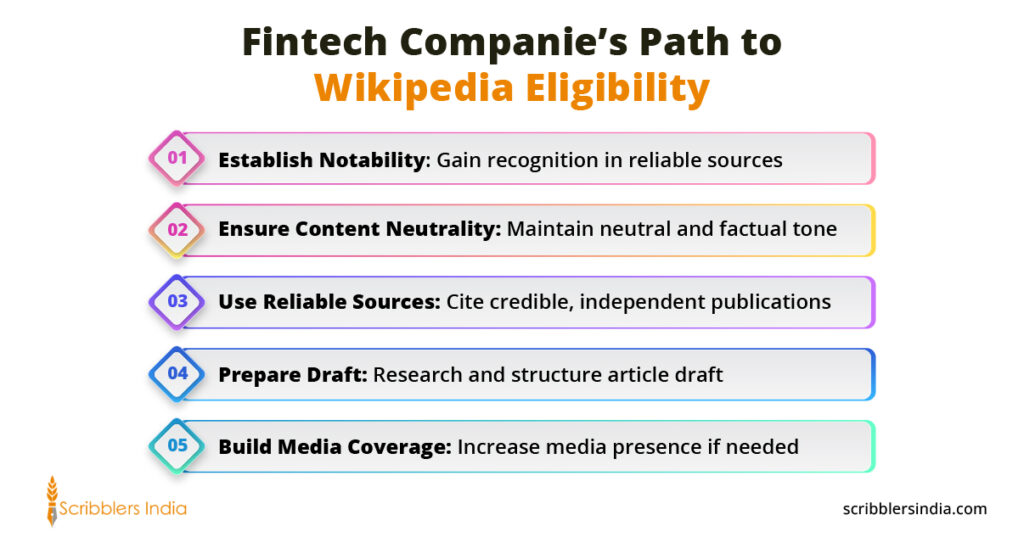

How to Navigate Wikipedia Challenges for Fintech Brands?

Creating a Wikipedia presence presents unique challenges for fintech brands, particularly in terms of editorial policies and reputation management. Wikipedia’s strict neutrality guidelines require specific approaches that differ from those used in standard marketing channels.

Understanding Wikipedia’s Conflict Of Interest policies

Wikipedia’s Conflict Of Interest (COI) policies maintain the encyclopaedia’s credibility. Direct editing of your own page can create problems, as these policies strongly discourage editing articles about yourself, your organization, or your clients.

COI happens when ‘an external relationship could reasonably be said to undermine an editor’s primary role’ on Wikipedia. Any financial relationship triggers a conflict, even holding cryptocurrency.

Fintech brands must follow these key requirements:

- Mandatory disclosure of any financial compensation for editing

- Transparency about employer and client relationships

- Abstaining from direct edits to pages where you have a conflict

Financial services rank among the most heavily regulated sectors globally. This presents a significant challenge to Wikipedia’s neutrality requirements for fintech firms.

Managing reputation risks on your fintech wiki page

Wikipedia has posed reputation challenges for several fintech companies. Two prominent UK fintech firms, Curve and Starling Bank, learned this the hard way. Their pages received warnings suggesting they may have edited their own entries to remove criticism.

The reputational damage from such incidents goes beyond Wikipedia. News outlets often report on controversial Wikipedia editing, which embarrasses the organizations involved. Fintech companies should handle risks by:

- Monitor your page regularly for accuracy

- Document inaccuracies with reliable sources

- Request changes through proper channels

- Avoid removing negative information directly

Working with independent editors effectively

Wikipedia values transparency above all. How we, at Scribblers India, understand this, is: ‘Be transparent about it. Explain that you are an employee, and share your sources for the correct information’.

The safest approach involves proposing changes on talk pages instead of editing directly. Use the {{edit COI}} template to suggest changes while disclosing your conflict of interest.

Your urgency to fix issues shouldn’t override proper channels. This approach protects your company’s reputation and Wikipedia’s integrity. External editors who respond to requests must verify information independently and provide appropriate attribution when implementing changes.

Why Choose Wikipedia Page Creation Services from Scribblers India?

Creating a successful Wikipedia page for FinTech companies needs expertise beyond simple writing skills. Fintech entrepreneurs who focus on growing their businesses find it hard to deal with Wikipedia’s complex policies.

Scribblers India offers comprehensive Wikipedia page creation services to help companies establish a credible online presence. Our team understands the challenges that fintech companies face in establishing themselves on this trusted global platform.

Here is what makes Scribblers India’s Wikipedia page creation services stand out:

- Expert Editorial Team: Our specialists are well-versed in handling Wikipedia’s strict guidelines. They create compliant, reliable pages that make your brand look great.

- Meticulous Research Approach: Each page is based on detailed research and trusted sources. Your fintech wiki content meets Wikipedia’s tough citation standards to build trust.

- Collaborative Process: Clear communication stays strong throughout the creation process. Regular updates and quick feedback make everything smooth and personalized.

- Ongoing Monitoring: Our service remains active after publication, with continuous page checks. The team handles updates and keeps up with Wikipedia’s changing policies.

Final Thoughts

A Wikipedia page is a valuable asset that can significantly enhance your fintech company’s digital presence in 2025. Wikipedia offers unmatched credibility, a wide reach, and significant SEO benefits that can directly impact your business growth.

Your fintech company will gain multiple benefits from Wikipedia. Third-party validation will improve your credibility. Search engines will rank you higher, and your domain authority will increase. Investors can quickly complete their due diligence process. New opportunities for international expansion will open up.

Want to opt for our Wikipedia page creation services and build your fintech company’s digital presence? Book a 1:1 consultation today!

FAQs

Why is a Wikipedia page important for FinTech companies in 2025?

A Wikipedia page enhances credibility, improves search engine visibility, and serves as a trusted source of information for potential customers, partners, and investors. It also supports due diligence processes and facilitates international expansion opportunities.

How does a Wikipedia page benefit a FinTech company’s SEO?

A Wikipedia page provides significant SEO advantages through its high domain authority, the potential for referral traffic, and opportunities for secondary backlinks. This can improve a FinTech company’s search rankings and overall online visibility.

What are the challenges in creating a Wikipedia page for a FinTech company?

The primary challenges include navigating Wikipedia’s conflict-of-interest policies, managing reputation risks, and collaborating effectively with independent editors. It’s crucial to maintain neutrality and adhere to Wikipedia’s strict guidelines for content creation and editing.

How can FinTech companies leverage Wikipedia page creation services for international growth?

FinTech companies can create localized Wikipedia pages in languages corresponding to their target markets. This helps educate new markets about their services, establish credibility with regional stakeholders, and adapt to local cultural contexts.

What are the key components of a successful FinTech Wikipedia page?

A successful FinTech Wikipedia page should include a comprehensive company history, detailed information about services and products, notable achievements, and proper citations from reliable sources. It should maintain a neutral point of view and adhere to Wikipedia’s notability criteria.