An annual report is your company’s most important story of the year. It is far more than a legal obligation. It is your single best opportunity to build trust with investors, inspire your employees, and impress stakeholders. This is where annual report writing services in India can make a difference. This document is also famously complex to create, demanding a blend of financial accuracy, legal compliance, and strategic narrative.

Many companies see this as a compliance chore, resulting in a document that is dry, dense, and unread. This guide is your roadmap to change that. We will help you transform this document from a complex obligation into a powerful strategic asset. This is your chance to showcase your true value and build lasting stakeholder confidence.

You will find special insights for Indian businesses, best practices for how to write an annual report, and details on when to seek professional help. Let us explore the path to a report that gets read and respected, a task where expert annual report writing services in India can be invaluable.

What Is an Annual Report?

An annual report is a comprehensive document that a company releases once a year to its shareholders and stakeholders. It details the company’s financial performance, operational activities, and future outlook, serving as a key tool for transparency and communication.

This report serves two primary purposes:

- Compliance: The report fulfills your legal requirements under laws like the Companies Act. It is a mandatory disclosure of financial performance, corporate governance, and executive compensation, ensuring you meet regulatory standards.

- Communication: It is your primary channel to tell your company’s story, articulate its vision, and build trust with your audience. This narrative provides essential context for the financial data, making it understandable and meaningful.

The key components of this annual report structure always include a leadership narrative, operational details, and audited financial statements.

What is the Importance of Annual Report for a Company?

You should care about your annual report because it is more than a legal document. It is a powerful strategic tool to build investor trust, align employees, and strengthen your brand’s reputation. A great report showcases your performance and vision.

Here is why it demands your strategic attention:

- Your Primary Tool for Investor Relations: A study by PwC found that 55% of investors use financial statements and note disclosures (which are a part of the annual report) as a primary source for making or confirming investment decisions. It is your main platform to speak directly to capital markets, providing the detailed, verified data they need for their analysis.

- A Pillar of Brand Trust and Transparency: Transparency involves being honest about challenges and the plan to overcome them. Your annual report is your official, on-the-record proof of performance, ethics, and integrity. This builds deep, lasting confidence with all stakeholders, from investors to customers.

- A Tool to Align and Motivate Internal Teams: A clear and compelling report gives employees a sense of purpose and pride. It shows them how their work contributed to the company’s success and where the organization is headed. This alignment is crucial for building a strong, motivated internal culture and retaining top talent.

- A Powerful Marketing and Recruitment Asset: A well-produced report showcases your stability, vision, and values. This makes it a valuable tool for attracting top talent who want to work for a successful, transparent company. It also reinforces your brand message to potential customers and strategic partners.

- A Single Source of Truth for Your Year’s Performance: The report consolidates your entire year’s performance—financial, operational, and social—into one verified document. It becomes the official, undisputed record for your company’s history. This is the value you seek from top-tier annual report writing services in India.

How Should I Structure an Annual Report?

A successful annual report structure typically has three main parts. The “front end” includes the brand story and CEO’s letter. The “middle section” contains operational details like the MD&A. The “back end” holds all the audited financial statements. A good structure is the foundation as this is the blueprint used by professional annual report writing services in India.

- The “Front End”: The Narrative & Brand Story: This is your report’s first impression, setting the tone and inviting the reader in. It must be engaging. This part typically includes the cover page and theme, the vital Chairman’s or CEO’s Letter, company highlights, and a clear statement of your vision and mission.

- The “Middle Section”: Operations & Governance: This section provides the crucial context behind the numbers. It includes the Management Discussion & Analysis (MD&A), which explains your performance. It also holds the detailed Corporate Governance Report and profiles of your Board of Directors and leadership team.

- The “Back End”: The Audited Financials: This is the non-negotiable core of the report, providing the “proof.” It contains the Independent Auditor’s Report, the Balance Sheet (Statement of Financial Position), the Income Statement (Profit & Loss), the Cash Flow Statement, and detailed Notes to Financial Statements.

A well-structured report is the difference between clarity and confusion. To dive deeper into a detailed format with specific examples for Indian companies, check out our complete guide on how to write an annual report.

Are the Annual Report Rules for Indian Companies?

Indian companies must follow rules set by the Companies Act, 2013, and the Ministry of Corporate Affairs (MCA). Listed companies face extra rules from SEBI (LODR), including mandatory reports like the Business Responsibility and Sustainability Report (BRSR).

Understanding this annual report compliance in India framework is critical.

Listed vs. Unlisted Company Requirements:

- Listed Companies must adhere to strict SEBI (Listing Obligations and Disclosure Requirements) Regulations. This includes filing the annual report with stock exchanges and providing the detailed Business Responsibility and Sustainability Report (BRSR). This demands extensive ESG disclosures, making their annual report compliance in India far more complex.

- Unlisted/Private Companies are primarily governed by the Companies Act, 2013, and MCA rules. Their reporting requirements are less extensive than listed entities. However, they still demand rigorous financial and directorial disclosures, including a detailed Board’s Report.

The Importance of the Director’s Report

The Director’s Report is a mandatory component under Section 134 of the Companies Act. It provides the Board’s comprehensive perspective on the company’s performance, financial position, key events, and future outlook. It also includes mandatory disclosures on governance, risk management, and director responsibilities.

Understanding CSR Reporting Mandates

Companies meeting certain net worth, turnover, or profit thresholds must follow CSR rules. They must report on their CSR policy, committee, and annual spending, detailing the projects, locations, and impact. This is a key area where annual report writing services in India provide critical legal clarity.

How Do Professional Writers Create an Annual Report?

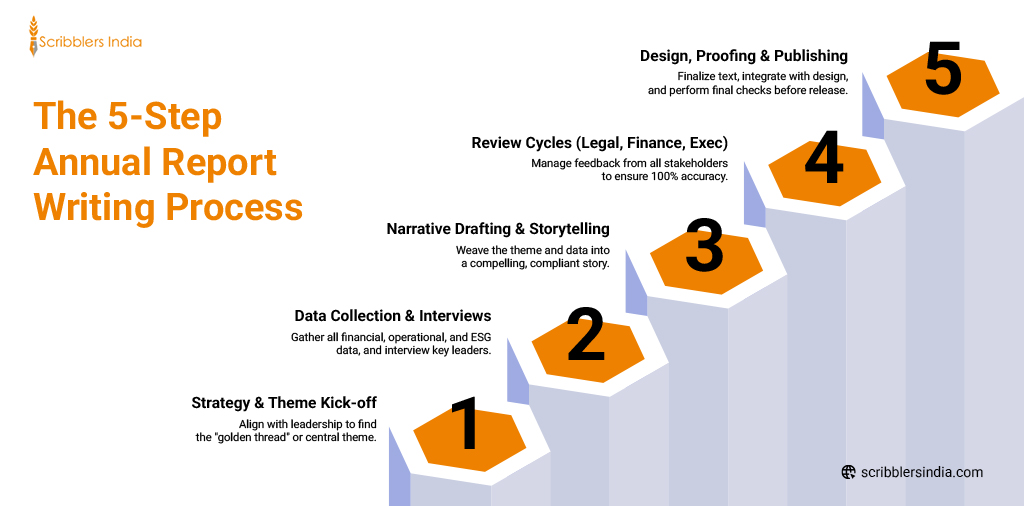

Professional writers follow a structured and multi-stage process. It starts with a strategic kickoff to define the theme. It then moves to data collection, stakeholder interviews, drafting the narrative, managing review cycles with finance and legal, and final fact-checking.

Step 1: The Strategic Kick-off and Theme Setting

Expert annual report writing services in India begin by aligning with leadership to define the central message. Is the story about resilience, innovation, or growth? This theme becomes the “golden thread” that guides the entire report and ensures a cohesive message.

Step 2: Data Collection and Stakeholder Interviews

This phase involves gathering all financial data, operational reports, and CSR metrics. Professional writers also conduct structured interviews with department heads and C-suite leaders to find compelling stories and authentic insights that live behind the raw numbers.

Step 3: Drafting the Narrative and First Pass

Here, the writer transforms the data and interview notes into a cohesive story. This is where how to write an annual report moves from science to art. They weave the central theme through the narrative, making complex information accessible and engaging.

Step 4: Managing Meticulous Review Cycles

The draft is meticulously reviewed by all stakeholders. The finance team checks every number. The legal team checks for compliance. Leadership checks for tone and message. Professional writers manage this complex feedback loop to ensure accuracy and consensus.

Step 5: Fact-Checking, Polishing, and Final Handover

A final, rigorous proofread ensures every figure, name, and statement is 100% accurate. The polished text is then handed over to the design team. This project management is a key benefit of using annual report writing services in India.

The writing process is part project management, part creative writing. If you are tackling it in-house, you will want a solid plan. Get our detailed workflow with our step-by-step guide to writing an annual report from scratch.

How Can I Make My Annual Report Interesting to Read?

You can make your report interesting by using annual report storytelling. Move beyond simply listing data. Find a central theme for the year. Weave this theme into the CEO’s letter, operational highlights, and even photo captions to explain the why behind your financial numbers.

Finding Your Story

Introduce a central theme like “Resilience,” “Innovation,” or “Connection.” This theme becomes the golden thread that connects your financials to your mission. It provides a memorable context for your achievements and a framework for discussing your challenges.

Turning Financial Jargon into a Compelling Narrative

As Warren Buffett often implies, “Write as if you’re talking to your sister.” Explain the impact of the numbers. Do not state “revenue grew 20%.” Explain how: “We grew revenue by 20% by helping 50,000 new small businesses succeed online.” This is the essence of effective annual report storytelling, a skill central to annual report writing services in India.

Great storytelling is what separates an award-winning report from one that gathers dust. Learn how to blend your communication strategy with investor expectations by using storytelling in annual reports to turn data into a compelling narrative.

What Makes a Good Annual Report Design?

A good annual report design uses layout, typography, and visuals to make complex information easy to understand. It ensures content-design harmony, uses infographics to simplify data, and prioritizes readability for both digital and print versions.

- The Harmony of Content and Design: Design is a critical tool for communication. A strong annual report design guides the reader’s eye, highlights key messages, and makes the document approachable. The visual tone must match the narrative tone, whether it is one of innovation or stability.

- Using Infographics to Simplify Complex Data: Use well-designed charts, graphs, and icons to visualize complex data. A clear infographic can explain your supply chain or financial performance effectively and memorably than three paragraphs of dense text.

- The Power of Professional Photography: Use authentic, high-quality photos of your people, products, and operations. Real photography builds trust and humanizes your brand far more than generic stock images. It shows, rather than tells, what your company is about and builds an emotional connection.

- Choosing Layout and Typography for Readability: Your report must be readable, above all else. Choose a clean, modern font. Use white space effectively to avoid overwhelming the reader. A cluttered page will discourage even the most interested stakeholder and signals a lack of clarity in your thinking.

- Designing for Digital-First and Print: Most stakeholders will read your report as a PDF on a screen. Design for this digital experience first. Ensure links are clickable, the text is easy to read without zooming, and the file is optimized. Many annual report writing services in India partner with design agencies to ensure this.

How Do I Handle Challenges or Bad News in an Annual Report?

You should handle bad news with transparency. Address the issue directly in the Management Discussion & Analysis or the CEO’s letter. Explain what happened, the impact on the business, and the concrete steps you are taking to address the challenge.

Hiding or obscuring bad news destroys trust faster than the bad news itself. Investors and stakeholders know that every business faces hurdles. They want to see that your leadership is aware of the problems and has a credible, well-reasoned plan to solve them. This is a challenge where annual report writing services in India can provide an objective, strategic voice.

Do Annual Reports Differ by Industry?

Yes, annual reports differ significantly by industry. A tech company will focus on R&D and user metrics. A manufacturing company will emphasize its supply chain and operational efficiency. A bank will prioritize risk management and regulatory compliance.

Your report must speak the language of your sector.

- For Tech & SaaS: Your report must focus on key metrics like ARR, user growth, R&D investment, and your innovation pipeline. Investors want to see your path to future growth and market leadership.

- For Manufacturing & B2B: Your report should focus on supply chain resilience, operational efficiency, safety records, and ESG impacts. These factors are crucial for long-term stability and profitability in your sector.

- For BFSI: Your report must heavily feature risk management, regulatory compliance, capital adequacy ratios, and customer trust. This demonstrates stability and prudent management to regulators and investors.

- For Non-Profits: Your report should focus on mission impact, donor stories, and program effectiveness. You must clearly demonstrate the stewardship of funds and how donations are creating tangible change.

Getting this sector-specific tone right is a hallmark of good annual report writing services in India.

How Has ESG Reporting Changed Annual Reports?

ESG (Environmental, Social, and Governance) reporting has fundamentally changed annual reports. It is no longer a small appendix. Investors and regulators demand detailed, data-backed proof of sustainability, social impact, and strong governance as part of the core strategy.

- The Rise of Integrated Reporting: As Paul Polman, former CEO of Unilever, stated, “This is not just a moral issue, it is an economic issue.” The integrated reporting framework connects your financial performance directly to your ESG performance. It shows a holistic view of how you create value beyond just profit.

- From ESG to BRSR in India: The Business Responsibility and Sustainability Report (BRSR) is India’s new standard, replacing the BRR. It mandates detailed, standardized disclosures on ESG topics for the top listed companies, making annual report compliance in India significantly more complex. This complexity is why many firms seek specialized annual report writing services in India.

- Why ESG is a Financial Imperative: High-quality, transparent ESG reporting can lead to a lower cost of capital. Investors increasingly see strong ESG performance as a proxy for good management, long-term resilience, and a lower risk profile, making it a financial imperative for modern corporations.

What Common Mistakes Should I Avoid?

The most common mistakes include using “franken-content” copied from various departments, hiding bad news, and using excessive jargon. Another major error is treating the design as a last-minute addition instead of a strategic component.

Avoid these common pitfalls:

- Mistake 1: Using “Franken-Content”: This happens when you copy-paste sections from different departments. The result is a report with no single voice, no clear theme, and inconsistent, often contradictory, messaging.

- Mistake 2: Burying or Hiding Bad News: A lack of transparency is a major red flag for investors. It shows a lack of accountability and damages credibility far more than the bad news itself ever could.

- Mistake 3: Forgetting Your Audience (Too much jargon!): Your report will be read by more than just financial analysts. Avoid overly technical jargon. Explain complex topics in simple, clear language to ensure your message reaches everyone.

- Mistake 4: Treating Design as an Afterthought: A bad design makes your company look unprofessional and disorganized. A wall of text or a poorly organized layout tells readers you do not value their time. This is a common mistake that professional annual report writing services in India help you avoid.

Why Do I Need Annual Report Writing Services in India?

You need annual report writing services in India because creating a report is a high-stakes, complex task. It drains hundreds of hours from senior teams. A specialist agency like Scribblers India ensures a strategic narrative, flawless compliance, and a professional product.

Here is how an expert agency adds value:

Get a Strategic Storyteller, Not Just a Writer

An agency’s job is to find the “golden thread”—the one big idea. We then weave it through 150+ pages of dense financial and operational data. This creates a compelling narrative that resonates, which is a core part of our annual report writing services in India.

Get Flawless Compliance with SEBI, MCA, and BRSR

Professional annual report writing services in India are fluent in Indian corporate law. We stay updated on the latest SEBI (LODR) requirements, Companies Act provisions, and new BRSR mandates, ensuring your report is 100% compliant.

Save Hundreds of Hours of Senior Management Time

Our team manages the entire project. This includes interviewing department heads, managing C-suite approvals, and liaising with designers. This frees up your finance, legal, and marketing teams to run the business. This is the project management value of our annual report writing services in India.

Get an Objective “Outside-In” Perspective

Your team is too close to the action. An agency can look at your company with fresh, expert eyes. We identify the real story that matters to external investors and communicate it in a way that builds maximum credibility.

Achieve Harmony Between Financial Data and Brand Narrative

The biggest challenge is bridging the gap between the finance team’s data and the marketing team’s story. Our annual report writing services in India act as that bridge, ensuring the report is both mathematically accurate and strategically inspiring.

Ready to transform your next annual report from a compliance document into your most powerful investor-relations tool?

At Scribblers India, we specialize in creating award-winning, strategically-driven annual reports for India’s leading listed and unlisted companies. We are one of the premier annual report writing services in India. We handle the annual report storytelling, compliance, and project management, so you can focus on your business.

Schedule a consultation with our annual report experts today!

Frequently Asked Questions About Annual Report Writing

Who is responsible for preparing the annual report?

The preparation is a collaborative effort. The CFO and finance team handle financials. The legal team ensures compliance. The CEO/Board approves the narrative. Many companies use annual report writing services in India to manage and write the document.

How long does it take to create an annual report?

The process is long, typically starting 3-4 months before the release date. This includes time for strategy, data collection, writing, multiple review cycles, design, and printing or digital publishing.

What is the difference between an annual report and an integrated report?

An annual report primarily focuses on financial performance. An integrated report (<IR>) is an evolution that connects financial performance directly with a company’s environmental, social, and governance (ESG) performance, showing a holistic view of value creation.

Are annual reports mandatory for private limited companies in India?

Yes. While they do not have the same extensive disclosure rules as listed companies, all private limited companies in India must prepare an annual report. This includes financial statements and a Board’s Report, to be filed with the ROC.

What is the MD&A section of an annual report?

MD&A stands for Management Discussion and Analysis. This is a critical narrative section where management explains the company’s financial results, the reasons behind the performance, and the key risks and opportunities it faces.